In an increasingly technology-driven world, how can general partners (GPs) harness tech solutions more efficiently to address limited partner (LP) concerns? Additionally, how can LPs optimize their use of technology? These critical questions were a key focus for the SS&C Intralinks 2024 LP Survey, produced in association with Private Equity Wire, which provides GPs with vital intelligence into LP decision-making and allocation sentiment for the upcoming 12 months.

The annual survey measured the sentiment of 251 investment professionals who work in the private markets, including family office allocators, portfolio managers/asset managers, pension funds and wealth managers. The vast majority (82 percent) are based in Europe, the Middle East and Africa (EMEA) or North America (NA).

This year’s survey found that LP concerns regarding GP technology, specifically related to reporting, continue. But there are also learnings to be drawn and ways in which GPs can rise to the challenge and improve their technological offerings to LPs.

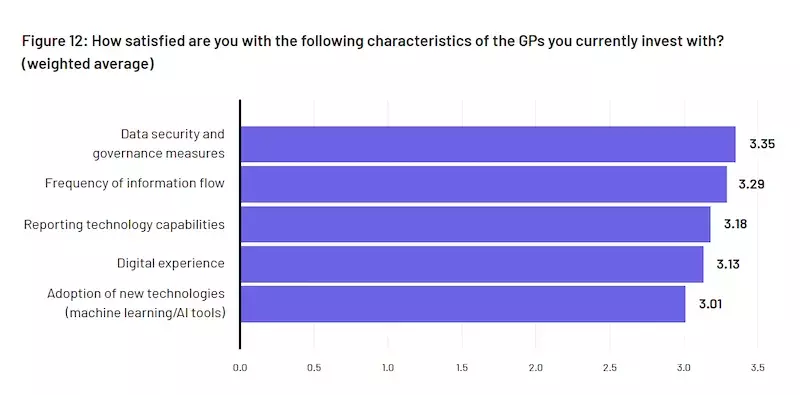

Are LPs satisfied?

First, the good news. LPs are generally content with the data security and governance measures in place at GPs they are currently invested in. A total of 41 percent expressed satisfaction, in contrast to just 10 percent who were dissatisfied. This level of satisfaction surpasses that of the other four topics surveyed, with the remaining respondents taking a neutral stance.

Dissatisfaction was highest when it came to the adoption of new technologies, such as artificial intelligence (AI) and machine learning, which is somewhat unexpected considering the significance private equity leaders are placing on AI.

"It’s not being talked about a lot [in public], but behind the scenes, at the biggest household private equity names in Europe, they’re all working on [AI]," Christophe De Vusser, head of Bain & Company’s EMEA private equity practice, told Financial News this summer.

Greg Mondre, co-chief executive of tech investment giant Silver Lake, said at a conference in Berlin, “The next mega-cycle is AI." Private equity portfolios could be transformed by the efficiencies and savings from well-targeted AI.

What potential lies within AI for LP/GP interactions and how LPs monitor their portfolios? Interestingly, a tenth of respondents said they would like AI capabilities to “scrape” data from PDF files. But there will be more opportunities to come in this area, and LPs want to hear more from GPs. By the time of the next survey, GPs should be better prepared.

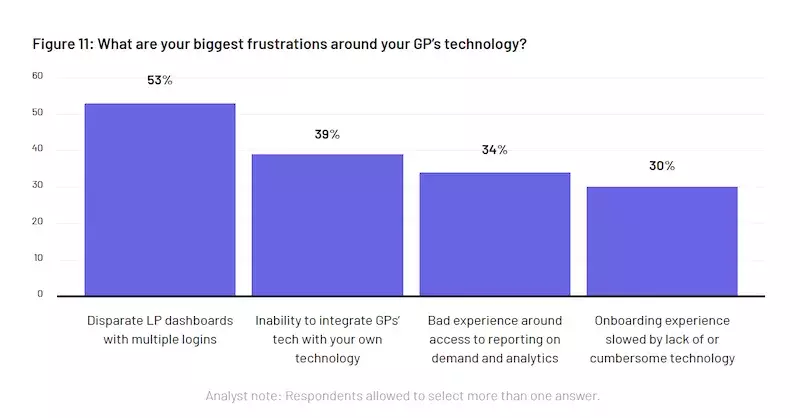

Biggest frustrations

What are the primary sources of frustration for LPs around GPs’ technology? More than half (53 percent) were unhappy with disparate LP dashboards with multiple logins, while 39 percent expressed challenges with the inability to integrate GPs’ tech with their existing tech infrastructure.

Multiple choices were allowed for this question, and over a third (34 percent) cited negative experiences related to accessing on-demand reporting and analytics while 30 percent said their onboarding process was slowed by lack of or cumbersome technology.

This question proved to be particularly enlightening, highlighting the dissatisfaction that LPs harbor against GPs regarding tech advancements. There is ample room for improvement. Private markets operators are investing in some of the most advanced and innovative businesses around, yet some are hindered by poor internal technology infrastructure.

Furthermore, the frustration is on the rise. The percentage of respondents choosing “disparate LP dashboards with multiple logins” as their biggest grievance has increased from 35 percent last year to 53 percent this year.

It is hardly surprising that nearly two-fifths (38 percent) of LPs are now considering the adoption of technology to aggregate data across their private markets portfolios, while almost half (49 percent) have already begun doing so. Only a small minority (13 percent) remain hesitant to consider this approach.

In the coming years, innovation will assume an increasingly pivotal role. LPs are also keen to enhance their ability to forecast cash flows, an area where GPs can provide valuable support through transparent and timely information, a choice highlighted by a fifth of survey respondents.

An additional 22 percent emphasized the importance of improved portfolio monitoring, which is linked to the ability to aggregate data across their portfolios.

Among respondents not currently using technology to aggregate data, nearly all (97 percent) said having a tool to aggregate data across their private markets portfolio would be beneficial.

Conclusion

LPs are eager for more innovation, particularly in the field of AI, to improve the technological offering from GPs. While private equity leaders often talk about how AI can revolutionize industries and their portfolio companies, how can it be leveraged to improve their relationship with LPs? This question should be a top priority for GPs based on the findings of this survey.

Furthermore, LPs are eager to embrace technology for portfolio and data monitoring, with a significant portion seeking a tool for aggregating data across their private markets portfolios. An increasing number are already making this transition, and innovation will continue to be the defining theme in this domain.

The 2024 SS&C Intralinks LP Survey is available to download here.