全球领先的

虚拟数据室 (VDR) 提供商

以无与伦比的安全和效率助您完成战略性金融交易

从并购 (MA) 虚拟数据室和银团贷款到募资、投资者入股、基金报告等。...

深受财富 500 强和最大做市商的信赖

Raytheon

美元 898 亿

SS&C Intralinks 促成了 898 亿美元的 United Technologies 对 Raytheon 的收购。

Dow

美元 573 亿

SS&C Intralinks 促成了 573 亿美元的 Dow Holdings Inc. 拆分。

Anaplan

美元 103 亿

SS&C Intralinks 促成了103 亿美元的 Thoma Bravo 对 Anaplan 的收购。

Whole Foods

美元 136 亿

促成了 33 亿美元的 SoftBank 对 Fortress Investment Group 的收购。

Fortress

33 亿 美元

SS&C Intralinks 促成了 33 亿美元的 SoftBank 对 Fortress Investment Group 的收购。

TSG Consumer

60 亿 美元

SS&C Intralinks 促成了 TSG 旗下专用于消费品行业的收购基金 TSG9 的募资。

Neuberger Berman

25 亿 美元

SS&C Intralinks 促成了 Neuberger NB Credit Opportunities 基金 II 的募资。

Riverside

18.7 亿 美元

SS&C Intralinks 促成了 Riverside Micro-Cap 基金 VI 的募资。

Hayfin

66.1 亿 美元

SS&C Intralinks 促成了 Hayfin’s Direct Lending 基金 IV 的募资。

Summit Partners

15.2 亿 美元

SS&C Intralinks 促成了 Summit Partner Europe Growth Equity 基金 IV 的募资。

Summit Partners

15.2 亿 美元

SS&C Intralinks 促成了 Summit Partner Europe Growth Equity 基金 IV 的募资。

全球深受信赖的

金融技术提供商。

Intralinks 在 20 多年前开创了 VDR,并在此后持续创新,引领行业。

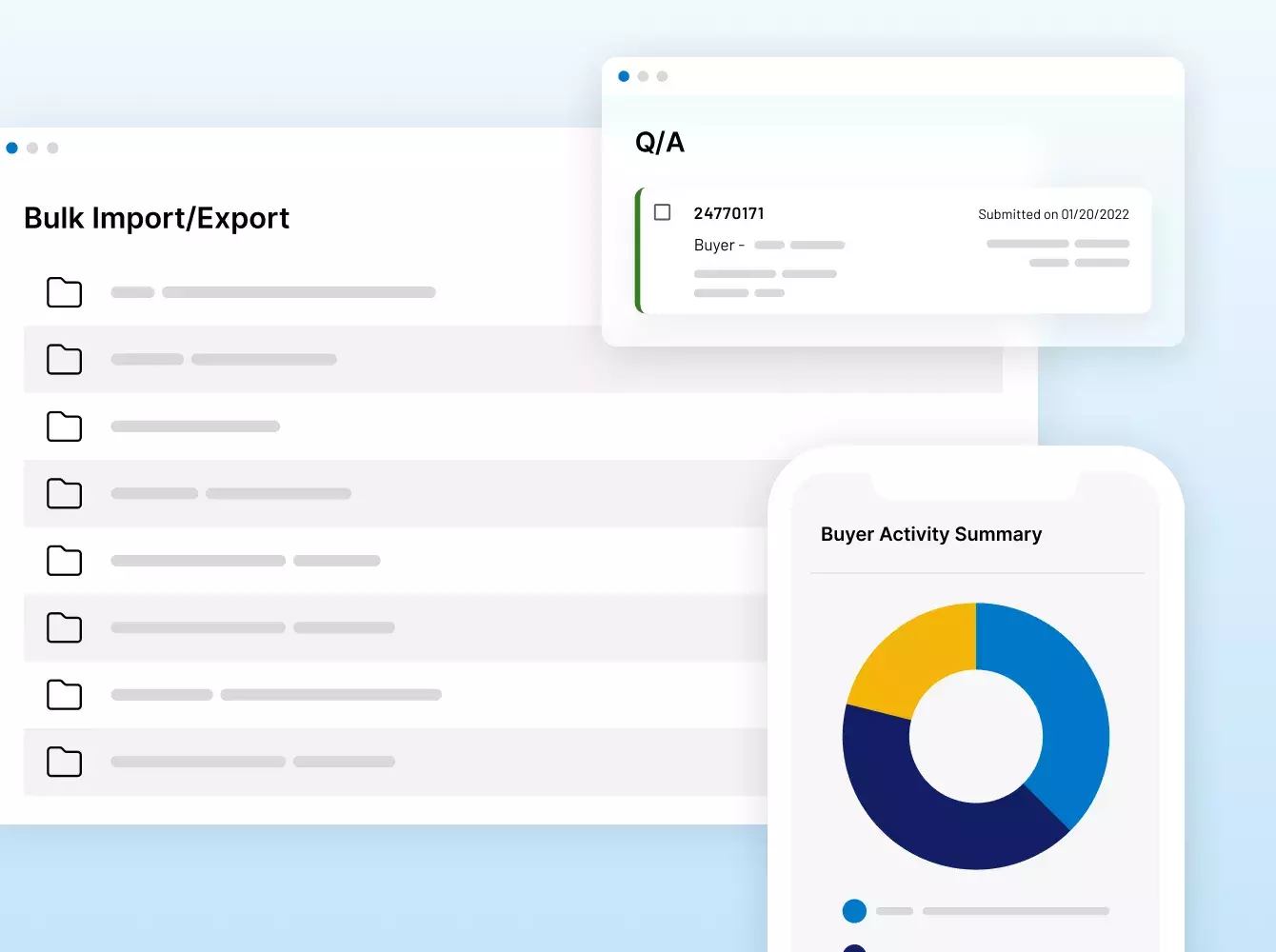

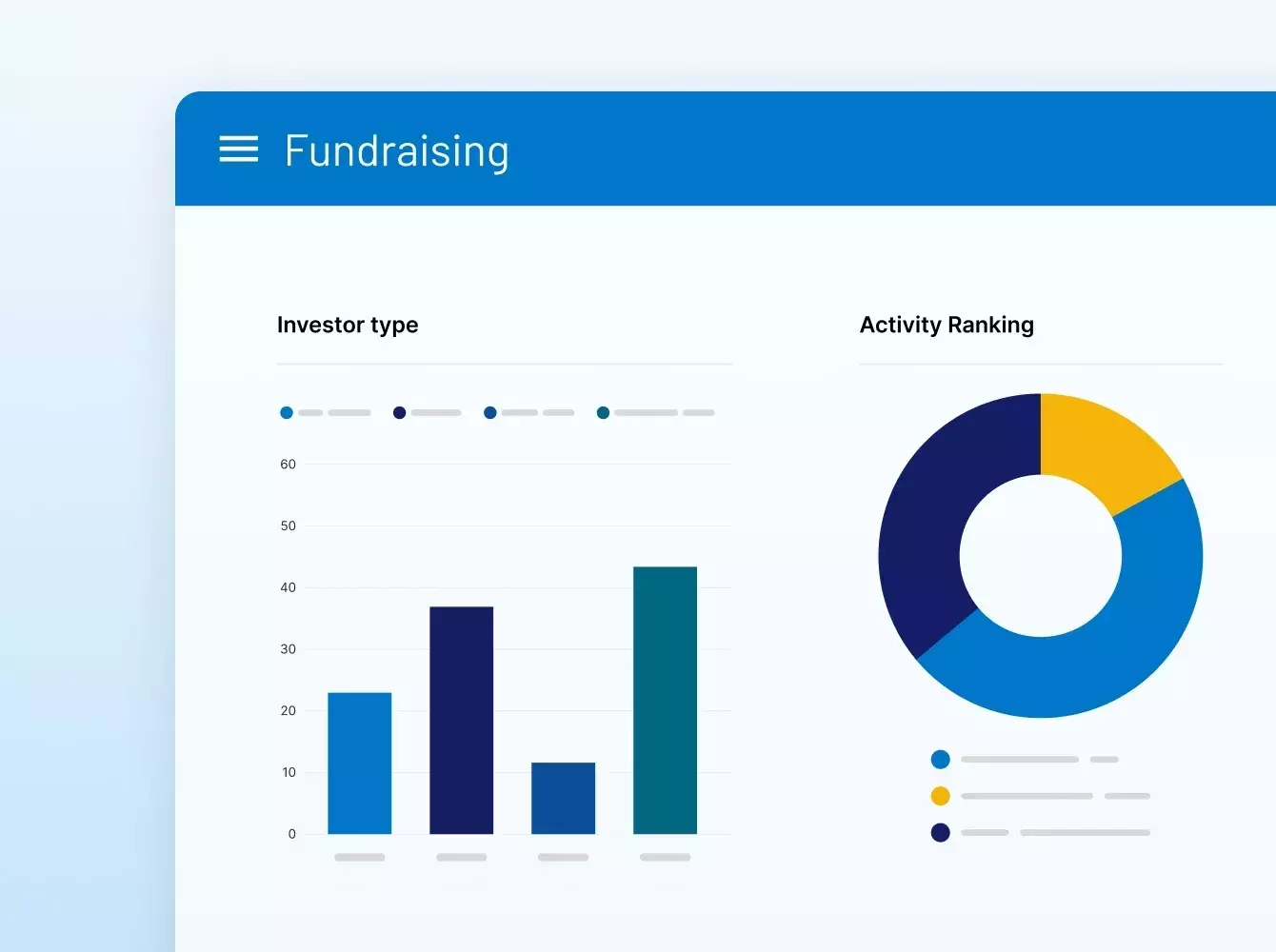

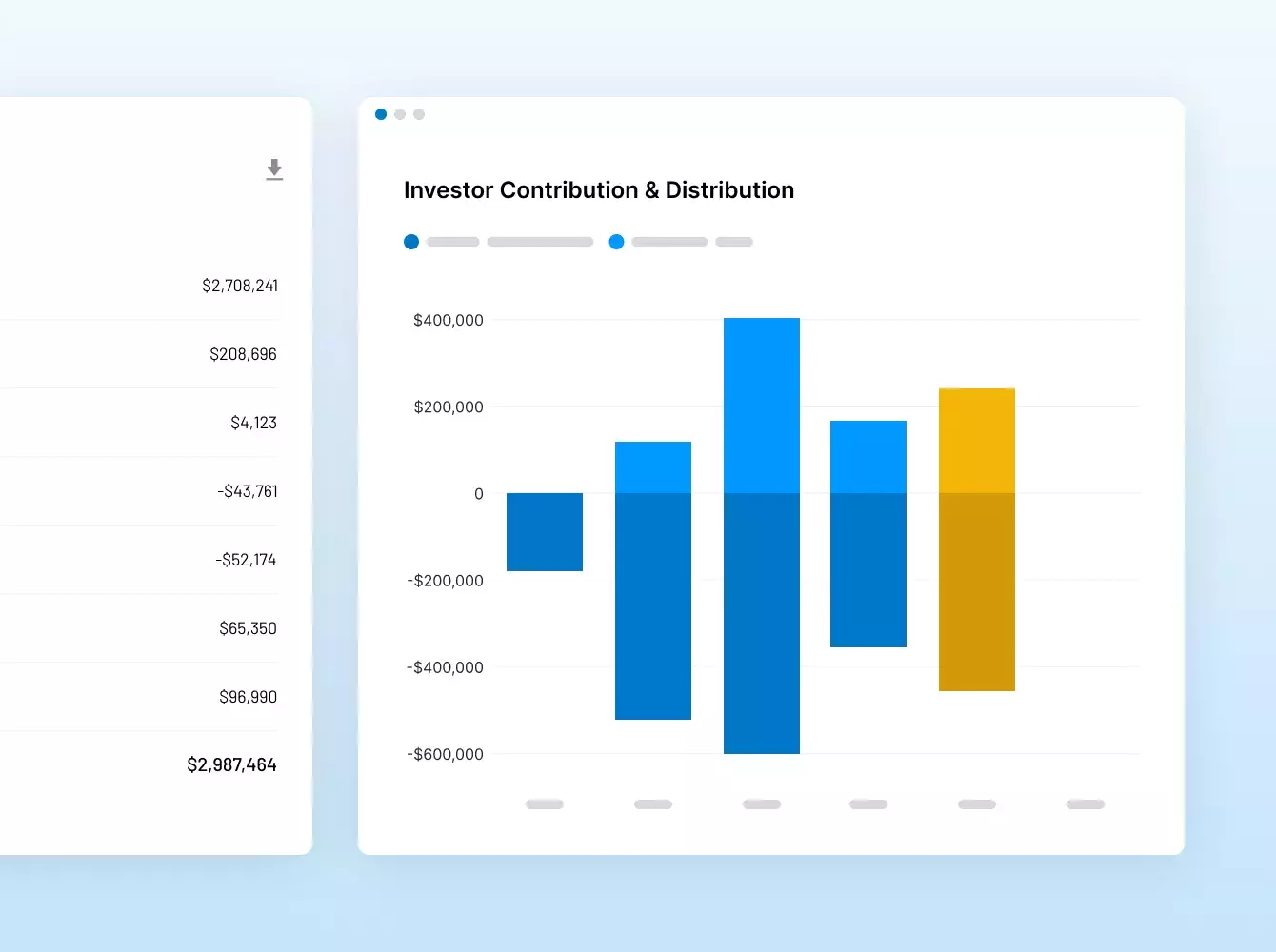

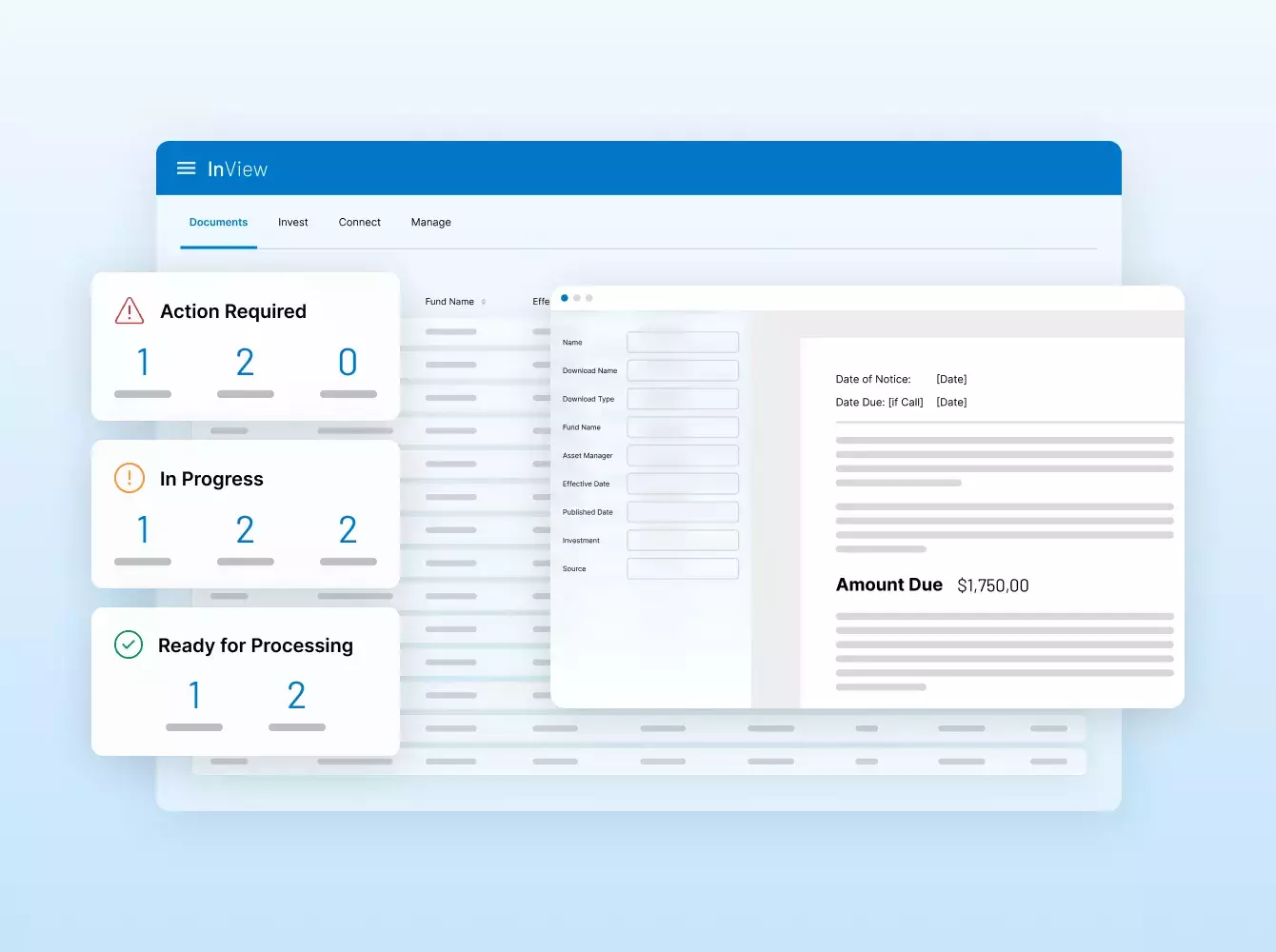

我们的解决方案为全球最大的资本市场交易提供支持,并使一般合伙人(GP)能够提供世界级的有限合伙人(LP)体验。

#1 并购

交易解决方案,已实现超过 35 万亿美元的金融交易

#1 GP-LP

社群拥有来自 10 万多个组织的 515,000 名个人

#1

募资平台

全球每募资 2 美元,就有 1 美元以上利用我们平台完成

超过 2 亿美元

过去五年的研发 (R&D) 的投资额&

ISO 27701

首家获得最高数据隐私认证的 VDR 提供商

平均6秒

联系到我们屡获殊荣的支持团队

需要建议您的客户

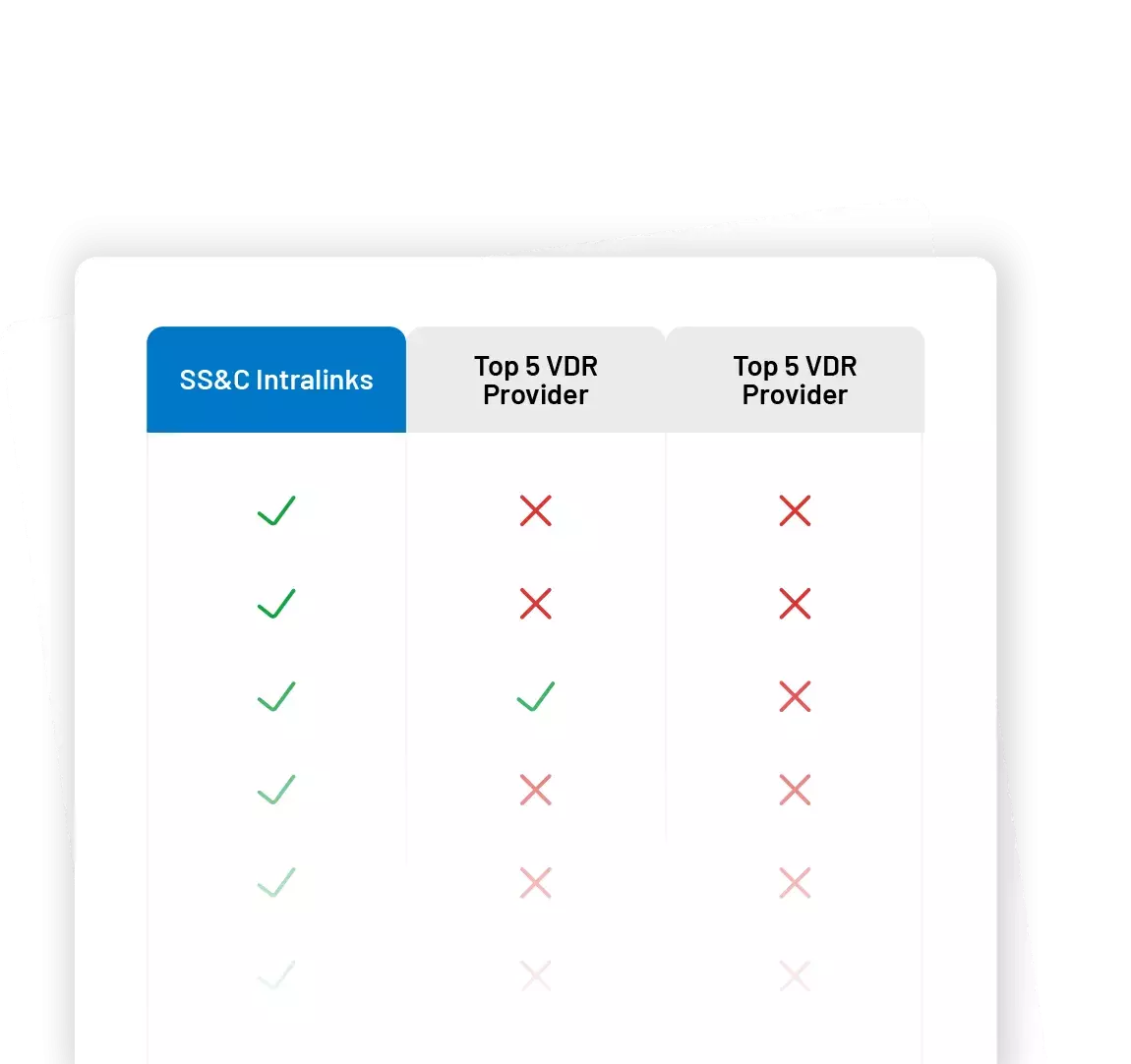

如何选择 VDR?

顾问们还是经常需要向客户展示与其他 VDR 替代产品对照的竞争优势。为了节省您的时间,我们构建了一个模板,其中包括主要 VDR 提供商之间的功能对比。

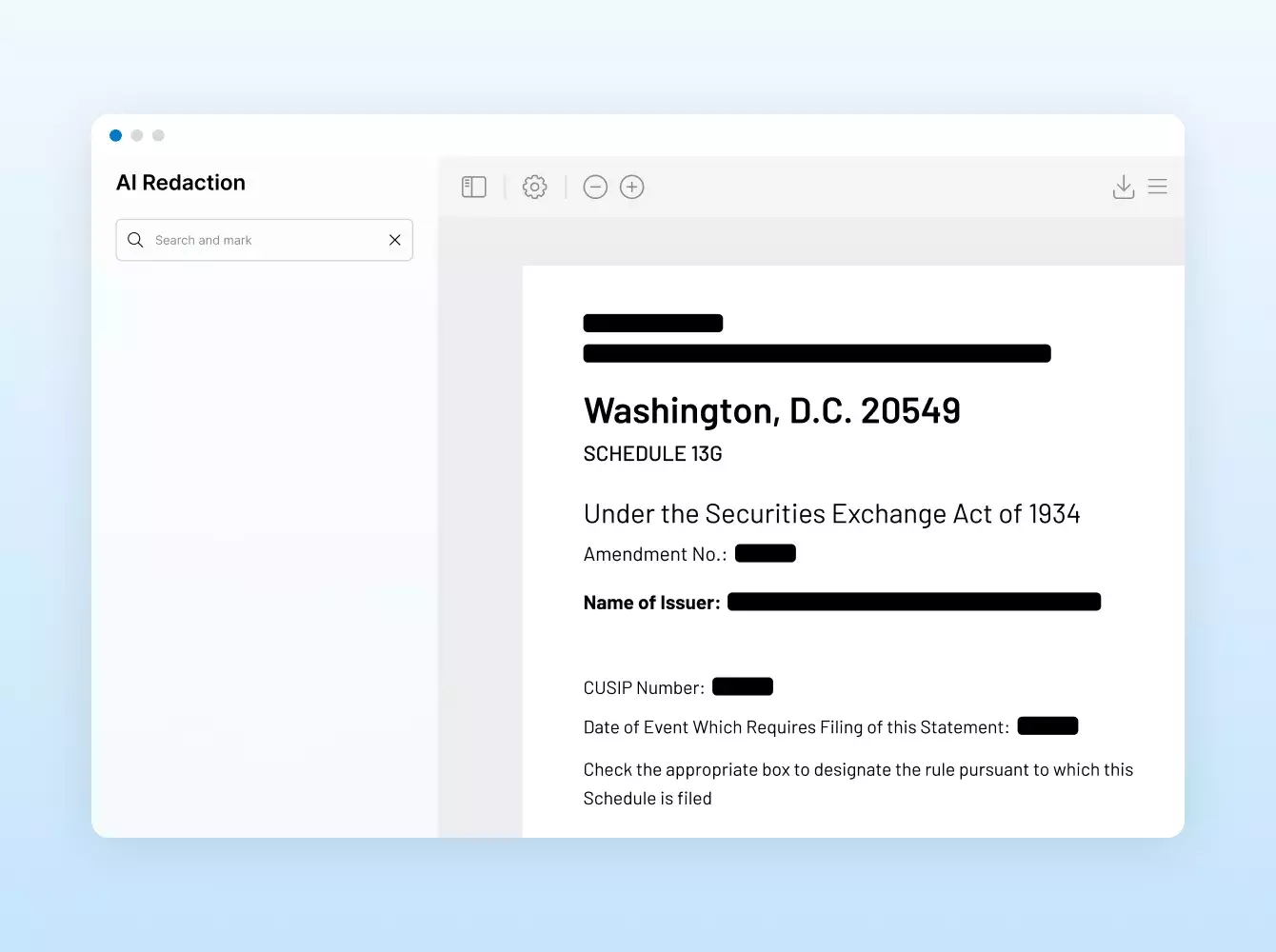

为什么我需要一个安全的地方存储数据?

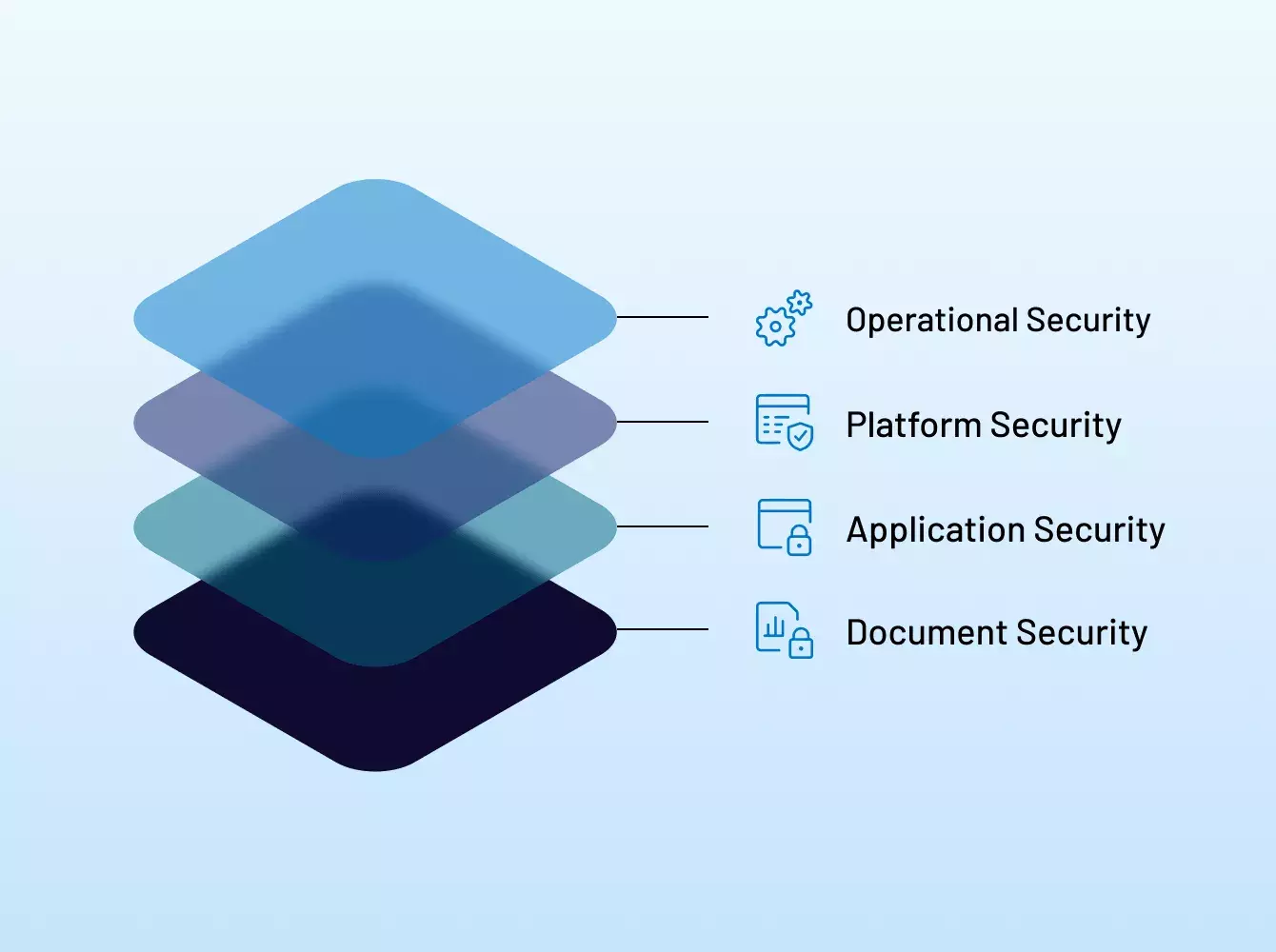

金融交易涉及众多文档,其中很多是机密文档,包含敏感信息。选择一家值得信赖、久经考验的提供商至关重要。在 Intralinks,我们的使命是通过一个专门为您、您的客户和合作伙伴提供安全保障的生态系统来保护您的交易和数据。

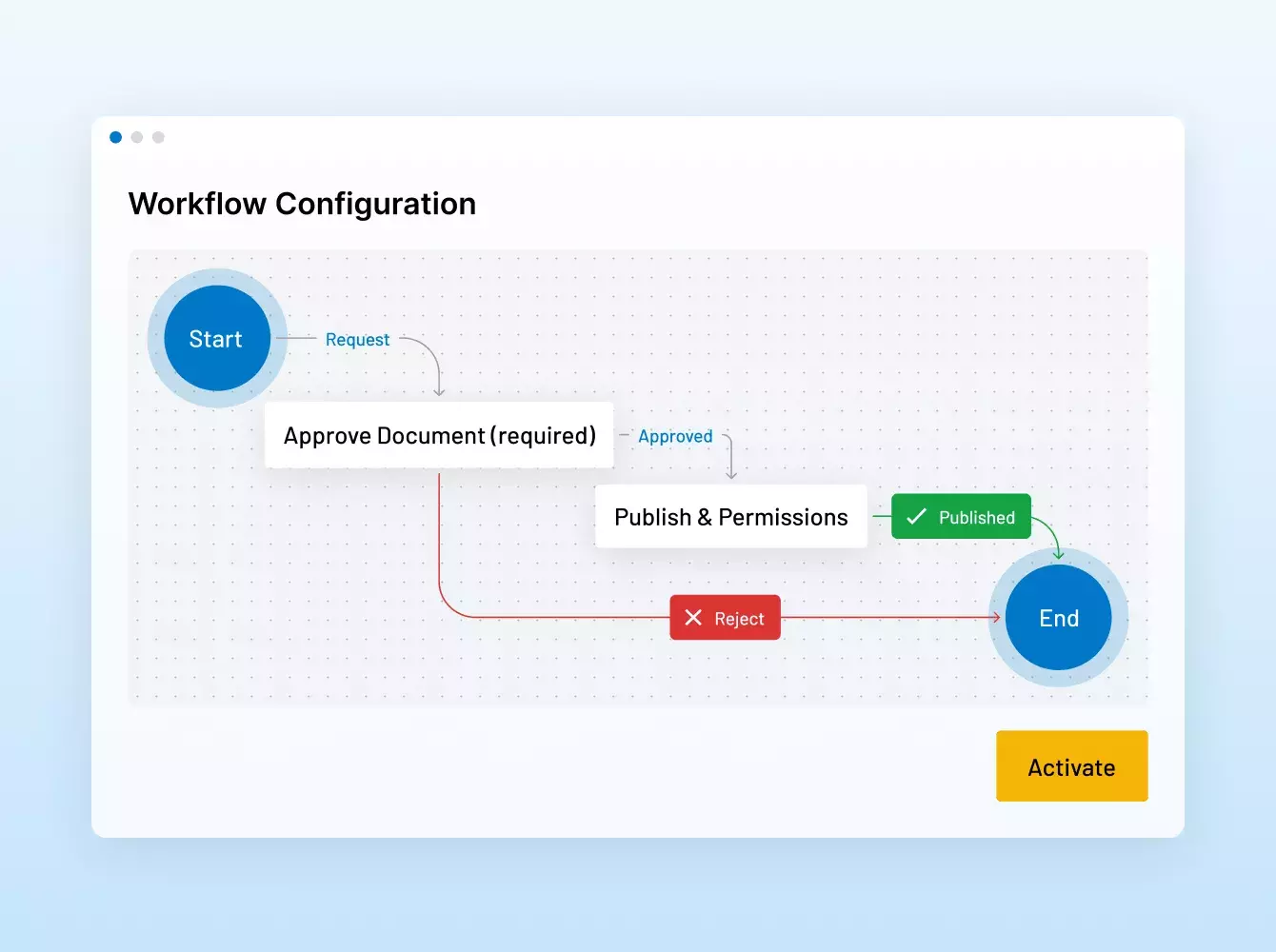

你们还提供哪些其他服务?

无论我们的客户是需要 VDR 设置方面的战术帮助,脱敏或保密协议 (NDA) 等繁琐任务的额外资源,还是具有自动化和复杂集成功能的完全定制式解决方案,Intralinks 的服务团队都可随时提供帮助。我们的服务产品结合了我们开创性技术、行业专业知识和数十年的经验,可以满足交易或项目各个阶段的任何要求。

与其他提供商相比,为什么你们是更好的选择?

Intralinks 是虚拟数据室 (VDR) 的先驱,不断对我们客户使用专门构建的解决方案和银行级安全的方式进行创新,以保护数据和信誉。我们得到了 SS&C 的支持,这是一家收入超过 60 亿美元的强大金融科技公司。在竞争对手缩减研发和服务规模的同时,我们继续投资,在五年内拨款超过 2 亿美元,旨在为我们的客户提供卓越体验。

其他文件共享解决方案不是同样安全吗?

否。尽管其他提供商声称自己很安全,但很多提供商故意使用模糊和误导性的语言来掩盖其真实安全认证。我们全面的安全防护包括业界领先,涵盖 Intralinks 人员、流程、政策和支持基础设施所有方面的认证和合规最佳实践。