Il luogo dove avvengono operazioni fundraising IPOs prestito sindacato finanziamenti

In modo intelligente.

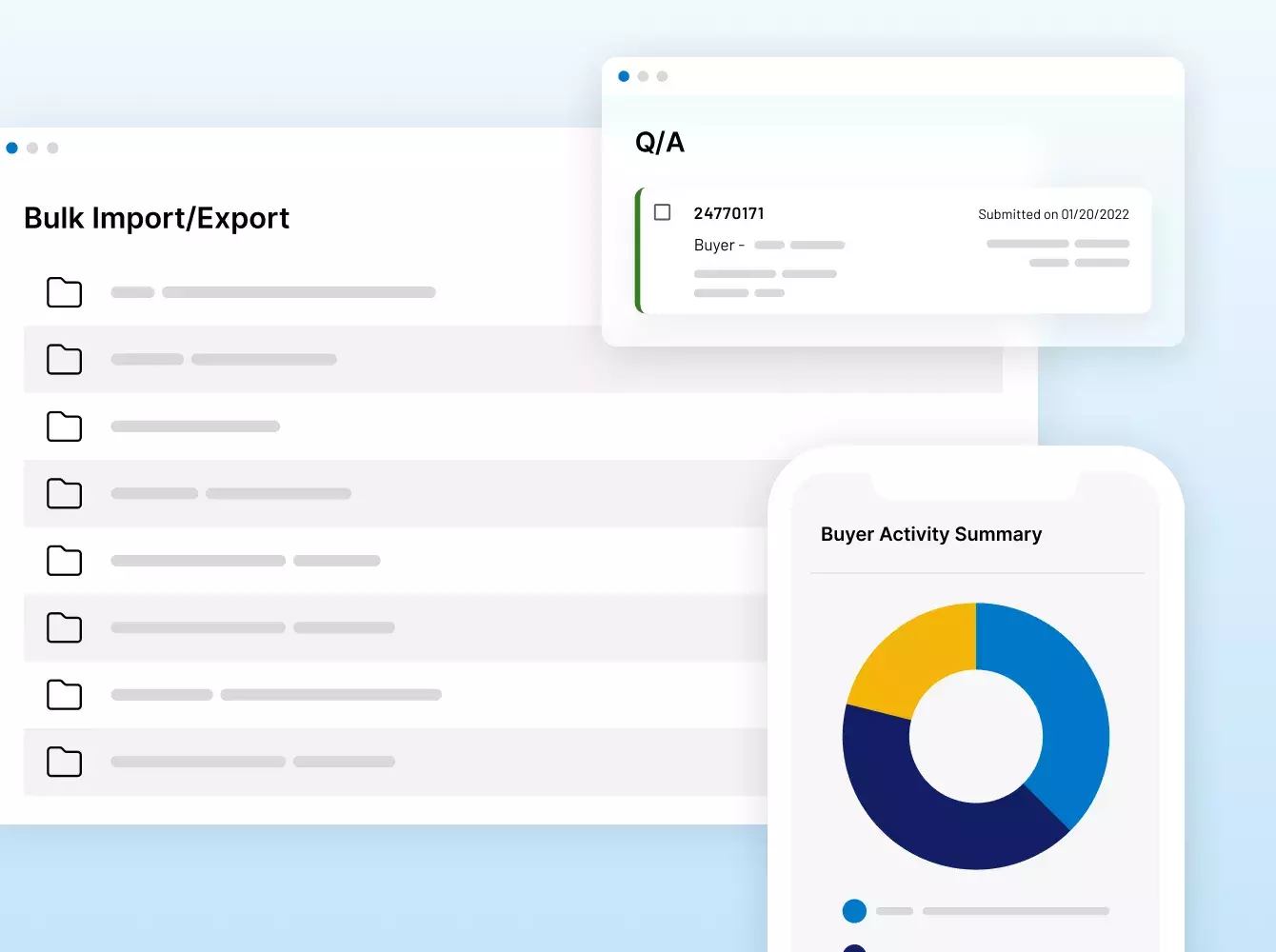

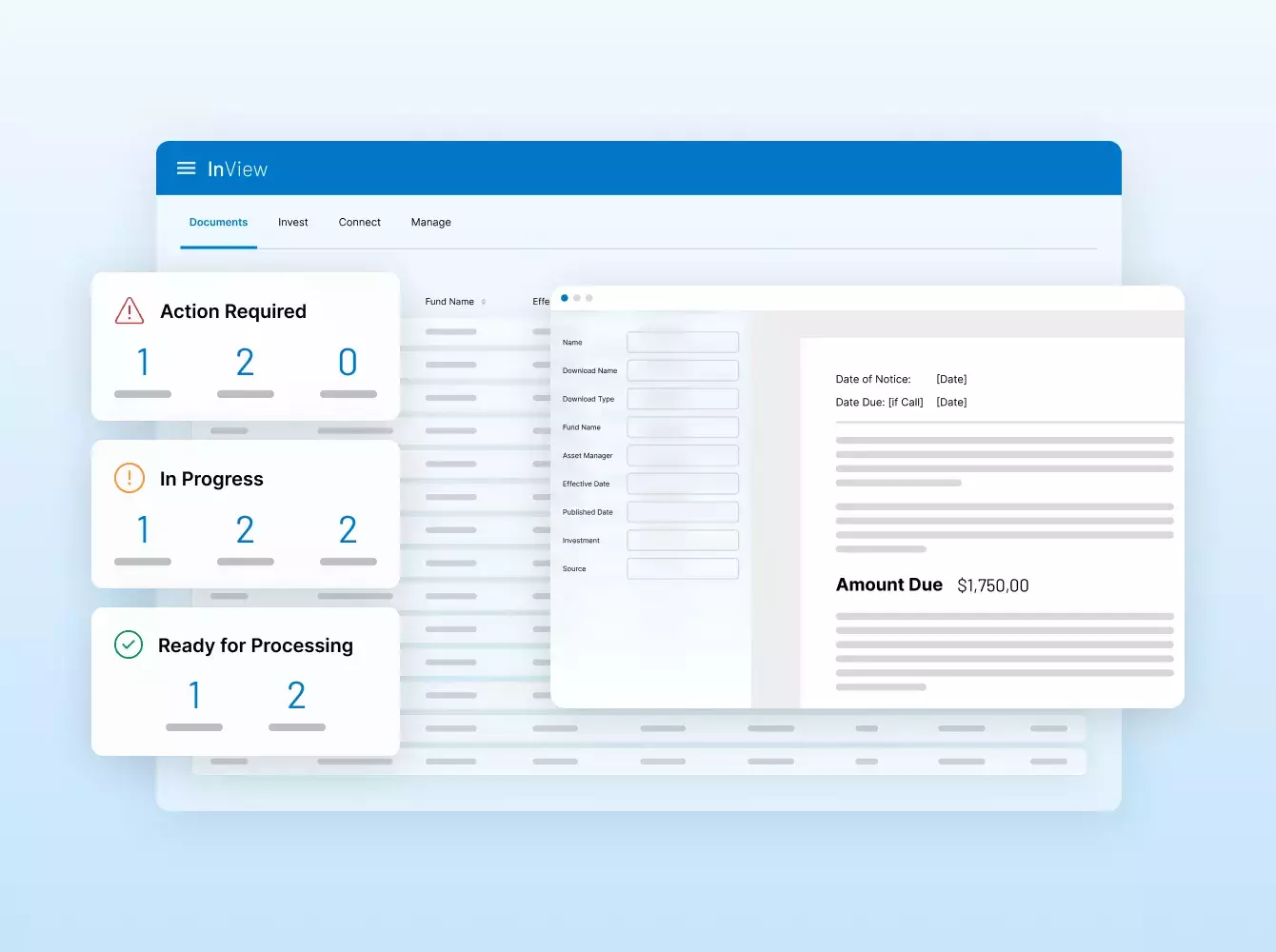

Per alimentare le vostre operazioni finanziarie strategiche con una sicurezza e un'efficienza senza pari, dalle data room virtuali M&A e dai prestiti sindacati al fundraising, all'onboarding degli investitori, al fund reporting e altro ancora.

Scelto dalle aziende Fortune 500 e dai maggiori market maker

Raytheon

$ 89,8 miliardi.

SS&C Intralinks ha facilitato l'acquisizione di Raytheon da parte di United Technologies per 89,8 miliardi.

Dow

$ 57,3 miliardi

SS&C Intralinks ha facilitato lo spin-off da 57,3 miliardi di dollari della Dow Holdings Inc. per gli azionisti.

Anaplan

$ 10,3 miliardi

SS&C Intralinks ha facilitato l'acquisizione da 10,3 miliardi di dollari di Anaplan da parte di Thoma Bravo.

Whole Foods

$ 13,6 miliardi

SS&C Intralinks ha facilitato l'acquisizione di Whole Foods da parte di Amazon per 13,6 miliardi.

Fortress

$ 3,3 miliardi

SS&C Intralinks ha facilitato l'acquisizione di Fortress Investment Group da parte di SoftBank per 3,3 miliardi di dollari.

TSG Consumer

$ 6 miliardi

SS&C Intralinks ha facilitato il fundraising per il fondo TSG9 di TSG, un fondo di buyout focalizzato sul settore dei consumi.

Neuberger Berman

$ 2,5 miliardi

SS&C Intralinks ha facilitato il fundraising per il fondo NB Credit Opportunities II di Neuberger.

Riverside

$ 1,87 miliardi

SS&C Intralinks ha facilitato il fundraising per il fondo Micro-Cap VI di Riverside.

Hayfin

$ 6,61 miliardi

SS&C Intralinks ha facilitato il fundraising per il fondo Direct Lending IV di Hayfin.

Summit Partners

$ 1,52 miliardi

SS&C Intralinks ha facilitato il fundraising per il fondo Europe Growth Equity IV di Summit Partner.

Summit Partners

$ 1,52 miliardi

SS&C Intralinks ha facilitato il fundraising per il fondo Europe Growth Equity IV di Summit Partner.

Il fornitore di tecnologia finanziaria più affidabile

al mondo.

Intralinks è stato il pioniere della VDR oltre 20 anni fa e da allora continua a innovare. Le nostre soluzioni alimentano le più grandi operazioni sui mercati dei capitali del mondo e consentono ai GP di offrire esperienze LP di livello mondiale.

Contattaci#1 M&A

soluzioni relative alle operazioni con oltre 35.000 miliardi di dollari di transazioni finanziarie

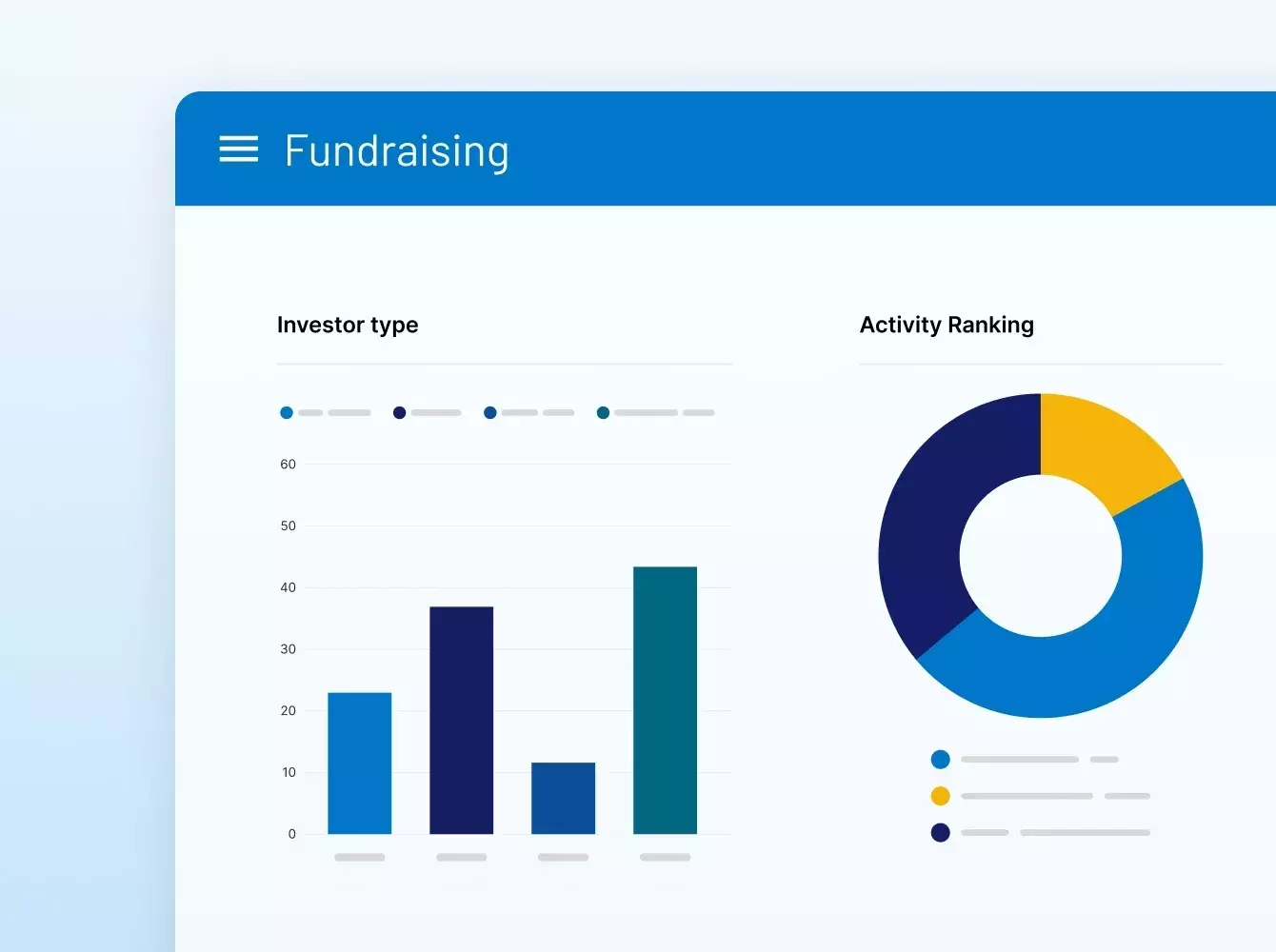

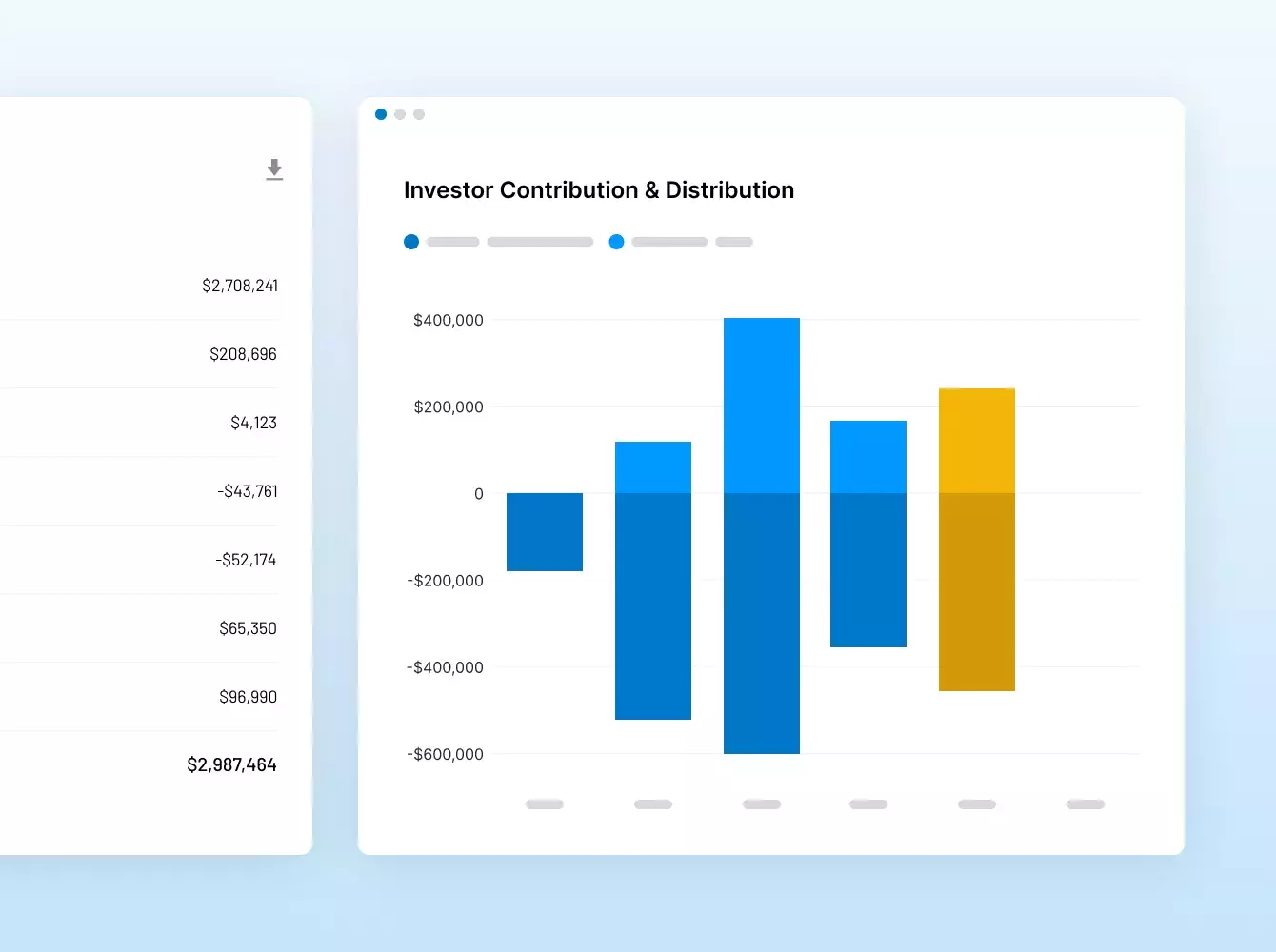

#1 GP-LP

Community di 515.000 persone provenienti da oltre 100 mila aziende

#1

Piattaforma di fundraising

Più di 1 dollaro per ogni 2 dollari raccolti a livello globale

oltre 200 milioni di dollari

Investimenti in R&D negli ultimi cinque anni&

ISO 27701

Il primo fornitore VDR a ottenere la più alta certificazione sulla riservatezza dei dati

6

Tempo medio in secondi necessario a raggiungere il nostro team di assistenza pluripremiato

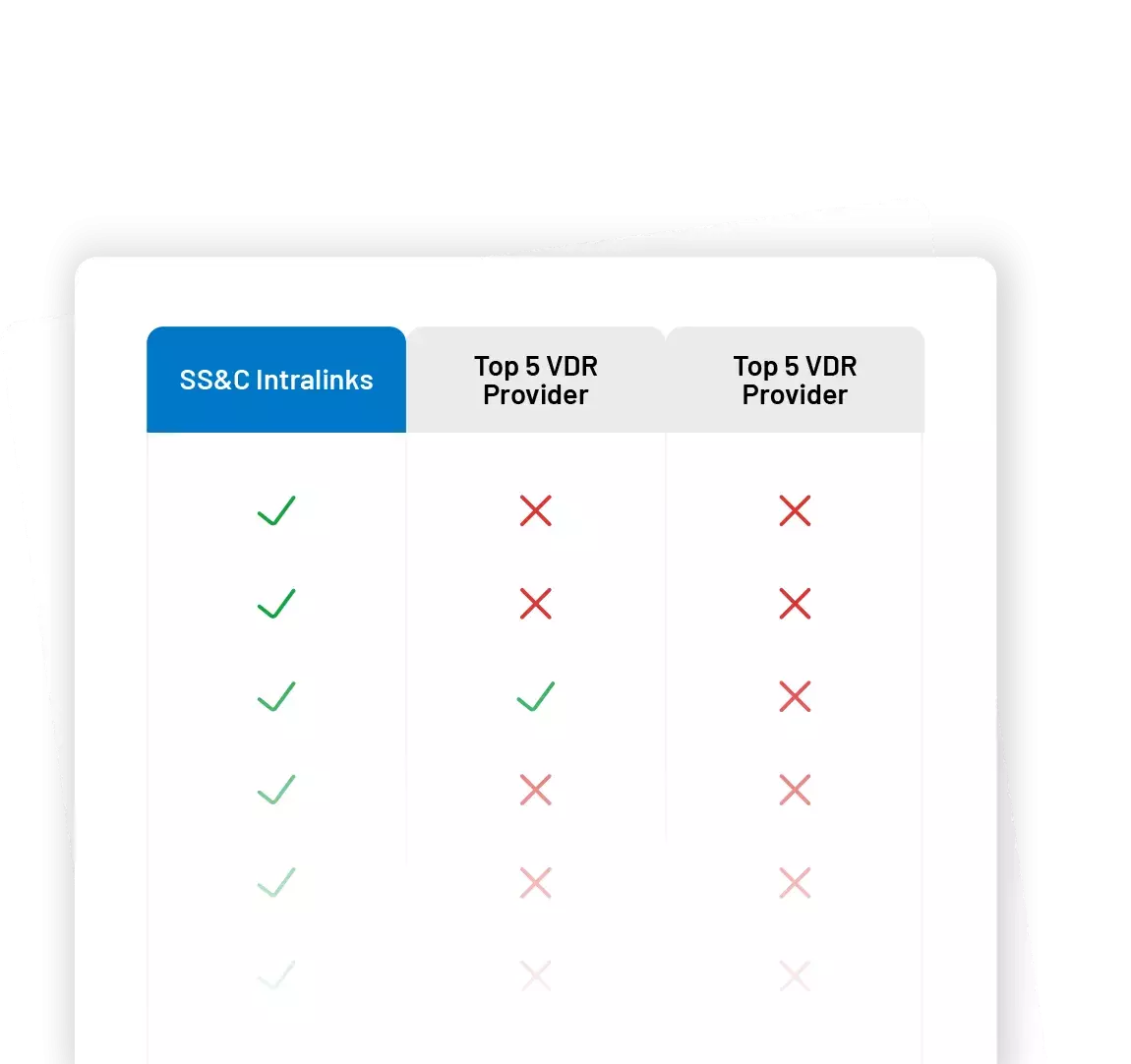

Hai bisogno di consigliare il tuo cliente

su come scegliere un VDR?

I consulenti devono spesso presentare ai loro clienti un confronto tra le alternative VDR. Per farti risparmiare tempo, abbiamo creato un modello che include un confronto tra le caratteristiche dei principali fornitori di VDR.

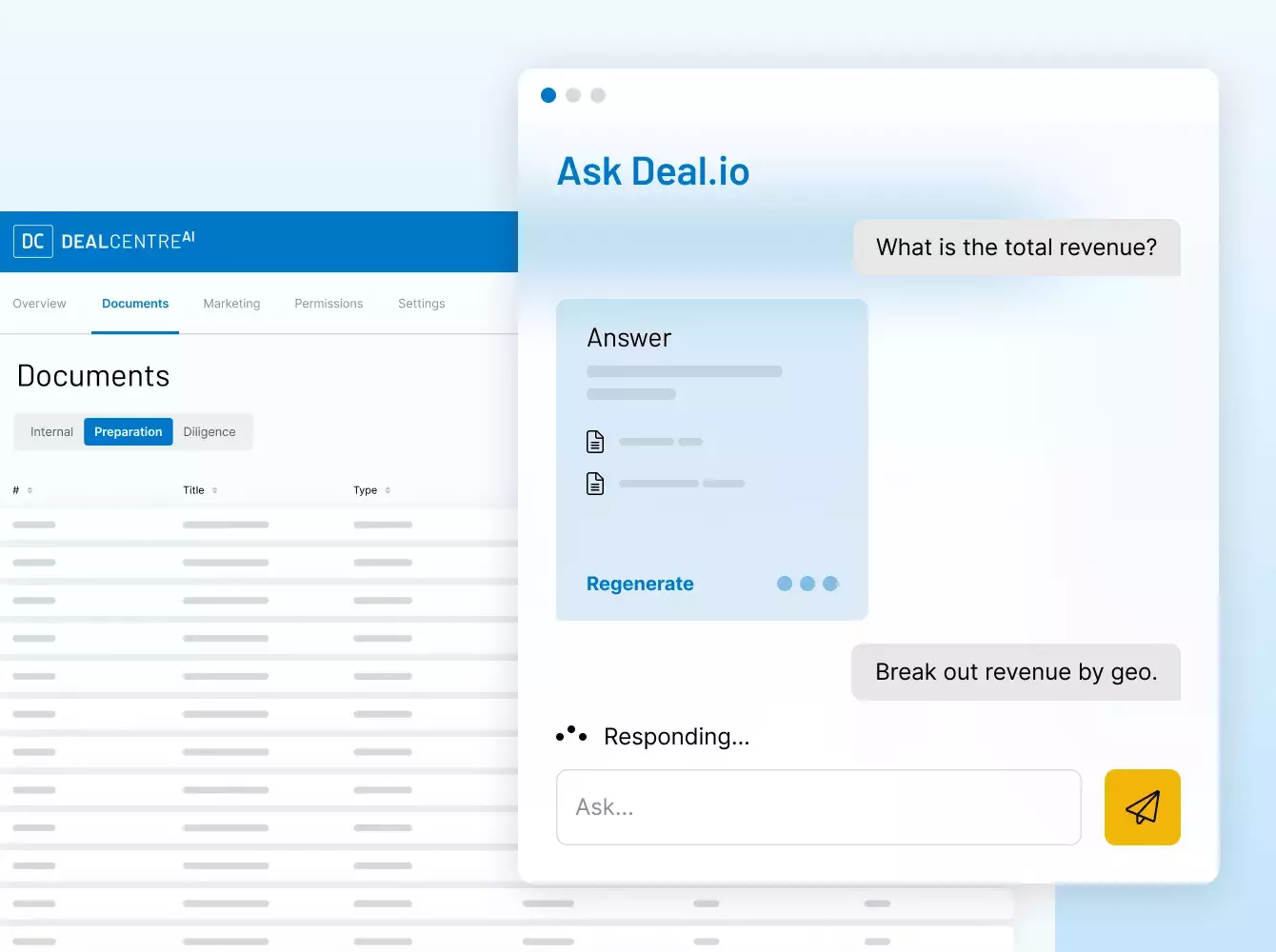

Perché ho bisogno di un luogo sicuro per i miei dati?

Le transazioni finanziarie comportano numerosi documenti, molti dei quali sono riservati e contengono informazioni sensibili. La scelta di un fornitore affidabile e collaudato è essenziale. La mission di Intralinks è salvaguardare le operazioni e i dati dei nostri clienti attraverso un ecosistema dedicato alla sicurezza (per voi, i vostri clienti e i vostri partner).

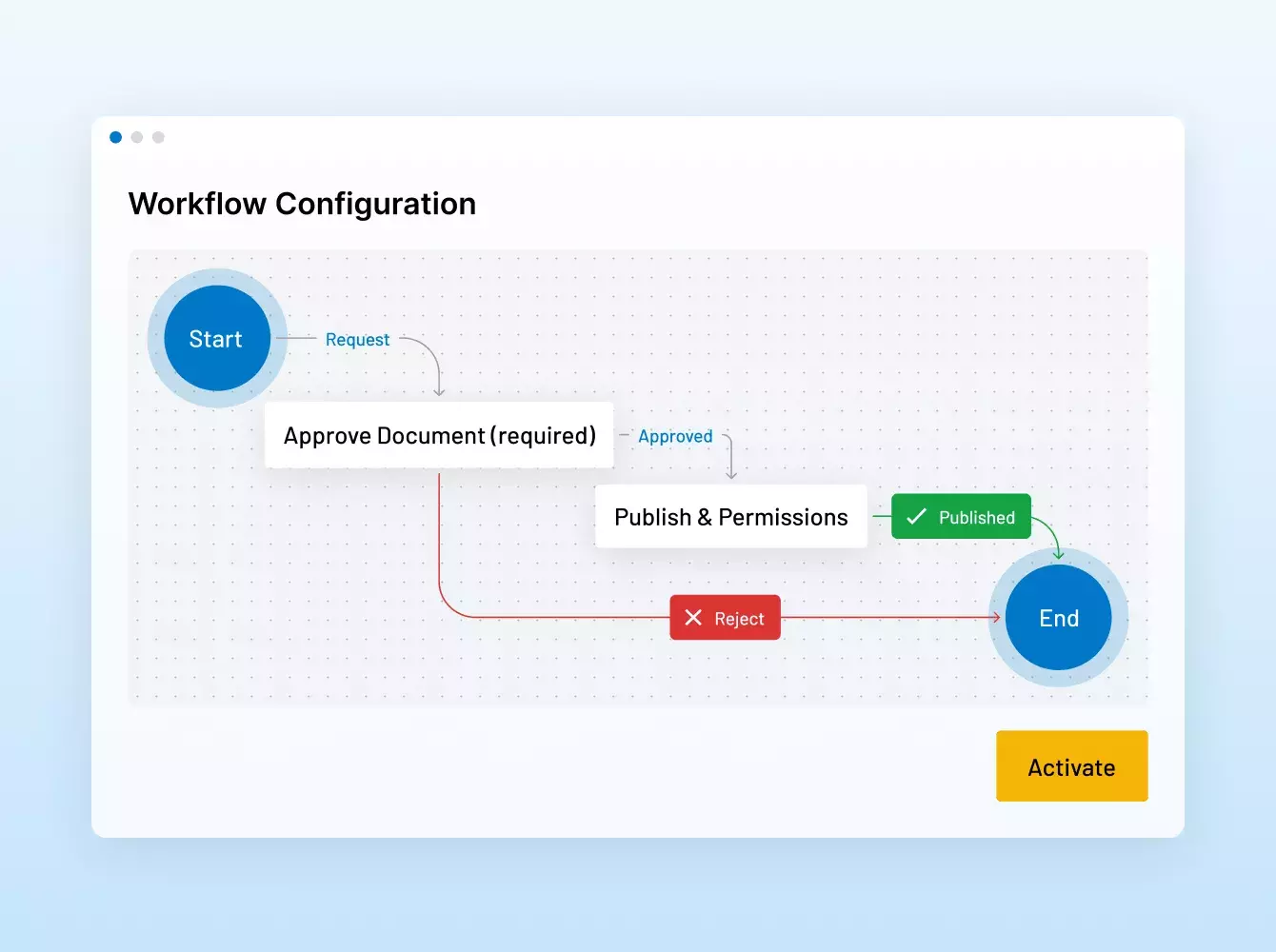

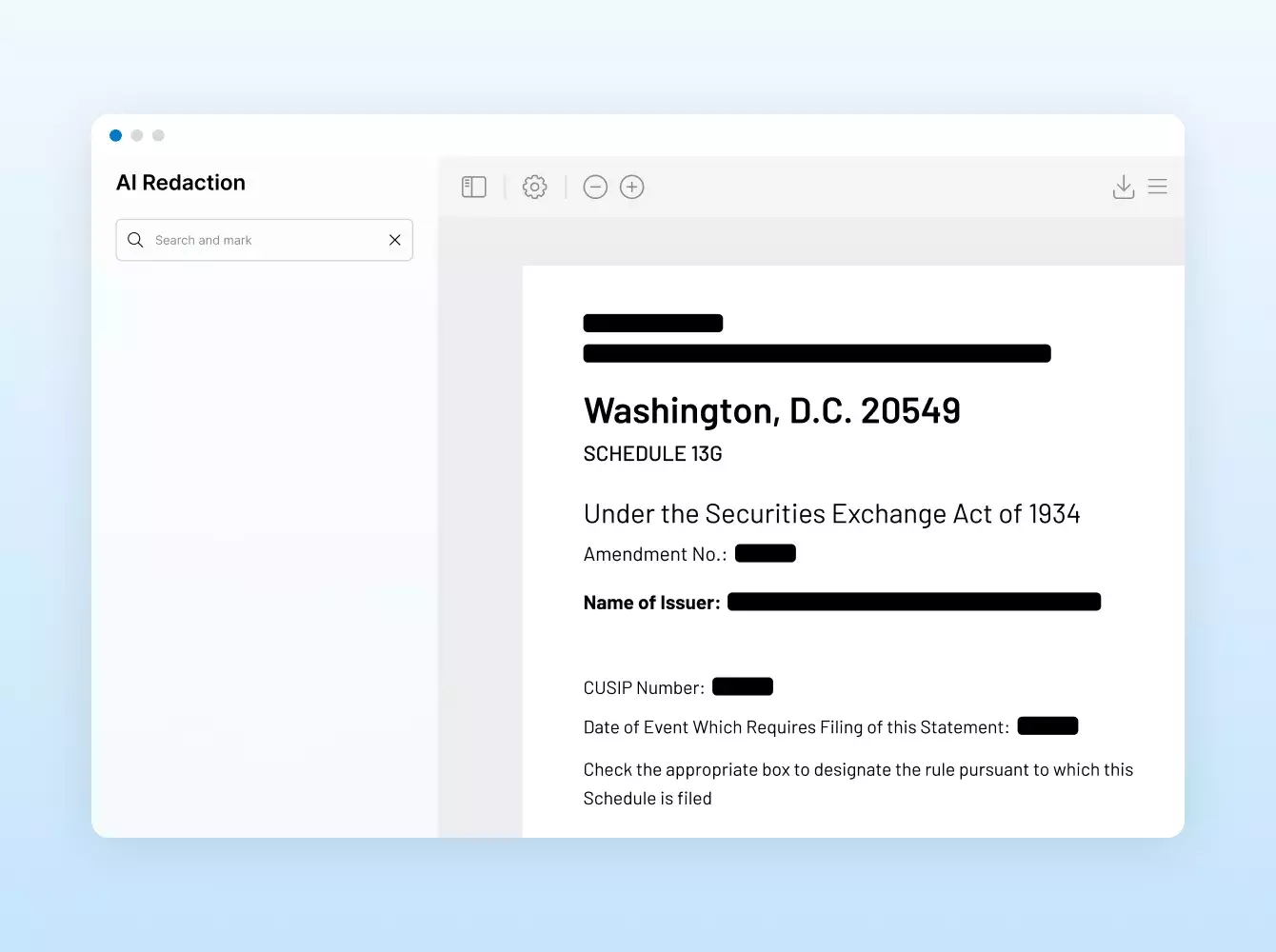

Quali servizi aggiuntivi offrite?

Che i nostri clienti abbiano bisogno di assistenza tattica per la configurazione di una VDR, di risorse aggiuntive per compiti noiosi come le redaction o gli NDA o di una soluzione completamente personalizzata con automazione e integrazioni complesse, i team di assistenza di Intralinks sono pronti ad aiutarli. La nostra offerta di servizi combina la nostra tecnologia pionieristica, la nostra competenza nel settore e la nostra esperienza decennale per soddisfare qualsiasi esigenza in ogni fase di un'operazione o di un progetto.

Perché costituisce una scelta migliore rispetto ad altri fornitori?

Intralinks è il pioniere della virtual data room (VDR) e innova continuamente il modo in cui i nostri clienti lavorano con soluzioni appositamente costruite e con una sicurezza specifica per i servizi bancari per salvaguardare i dati e la reputazione. Siamo sostenuti da SS&C, un'azienda fintech potente, con un fatturato di oltre 6 miliardi di dollari. Mentre i concorrenti riducono le attività di R&D e i servizi, noi continuiamo a investire, stanziando oltre 200 milioni di dollari in cinque anni per offrire ai nostri clienti un'esperienza di livello mondiale.

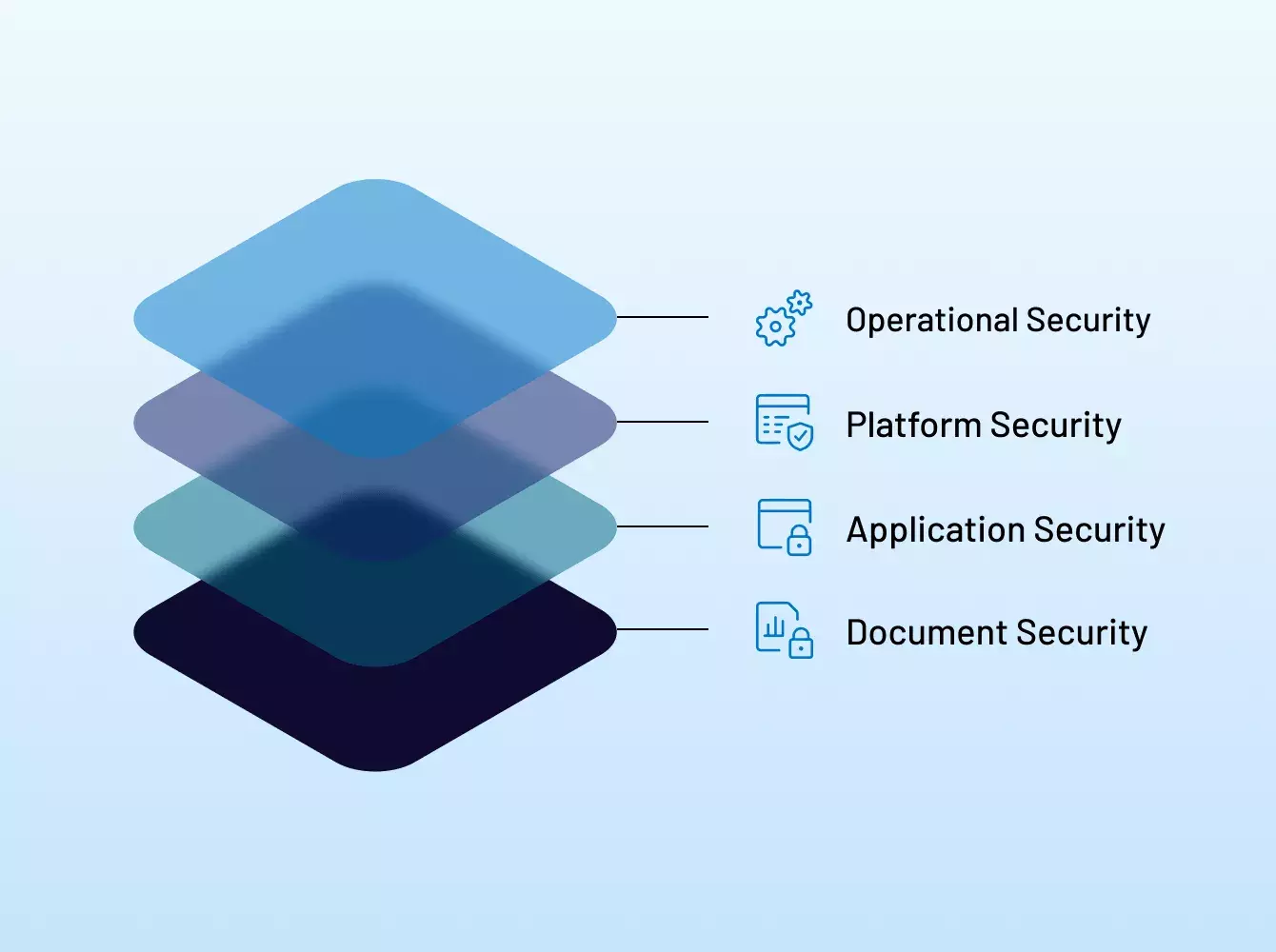

Le altre soluzioni di condivisione dei file non sono altrettanto sicure?

Anche se altri provider dichiarano di essere sicuri, molti utilizzano un linguaggio deliberatamente vago e fuorviante per mascherare le loro vere credenziali di sicurezza. Il nostro approccio integrato alla sicurezza comprende certificazioni leader del settore e best practice di conformità che si estendono a tutti gli aspetti del personale, dei processi, delle politiche e dell'infrastruttura di supporto di Intralinks.

Avanti.

- Sicurezza leader del settore

- Portata e affidabilità globali

- Soluzioni versatili e di facile utilizzo

- Assistenza best-in-class